How it works

A simpler way to gain access to private commercial real estate deals.

We’re giving individual investors the keys to build a professionally managed commercial real estate portfolio.

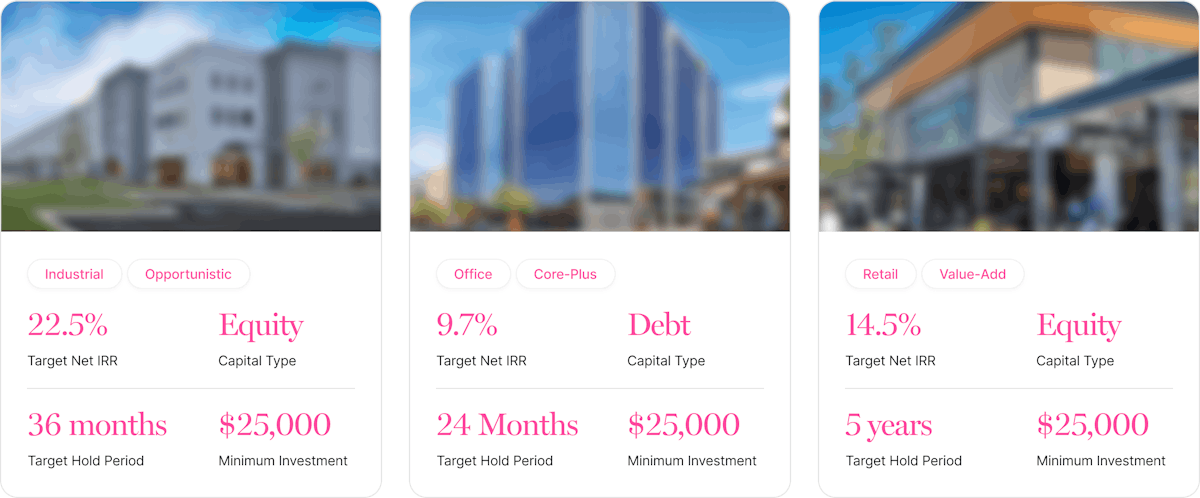

You have control

Invest directly into individual real estate deals on the RealRaise Marketplace

Direct real estate investment means investing directly into the equity of the project of your choice. These are not funds that makes investments on your behalf. As a passive investor, you’ll leverage the power of syndication and join other like-minded investors to contribute to the capital stack in a private real estate deal.

Your capital will go directly to the real estate manager behind the project because RealRaise never acts as an intermediary for any direct real estate investment.

Why Invest Directly

Whether you’re an experienced investor or new to investing, start your journey to a diversified investment portfolio by including direct real estate.

Construct your own portfolio

Access nationwide deal flow

Transparency across all deals

Construct your own portfolio

Access nationwide deal flow

Transparency across all deals

The RealRaise Model

Sourcing

We are connected to professional real estate managers in all major Australian cities with deal flow from a wide range of property classes and geographies.

Due Diligence

We apply detailed review process into real estate managers and individual deals. We only bring the best of the best private real estate deals to the marketplace.

Execution

A real estate manager with a proven track record works to protect your principal and maximize returns.

Sustained Growth

You build a diversified portfolio of cash-flowing, professionally managed real estate.

How it works?

RealRaise account setup is a quick and seamless process. Click the provided link to register and gain access to your investor portal within 5 minutes. After verifying your account, you can browse the available investment options. You'll have access to comprehensive diligence information and can ask questions or make an offer to invest.

Creating an account is optional, and it offers an exclusive opportunity to explore RealRaise's investment options without any obligation to proceed further.