Welcome to the future of private real estate investing

Professionally managed investments, build your own portfolio today.

View investmentsView investmentsView investments

Why Private Real Estate?

Income

Real estate has proven its ability to deliver consistent income streams to investors.

Risk-adjusted return

Just because it might be less risky doesn’t mean return potential will be sacrificed.

Stability

While other types of investments may go up and down, real estate has a reputation for low volatility.

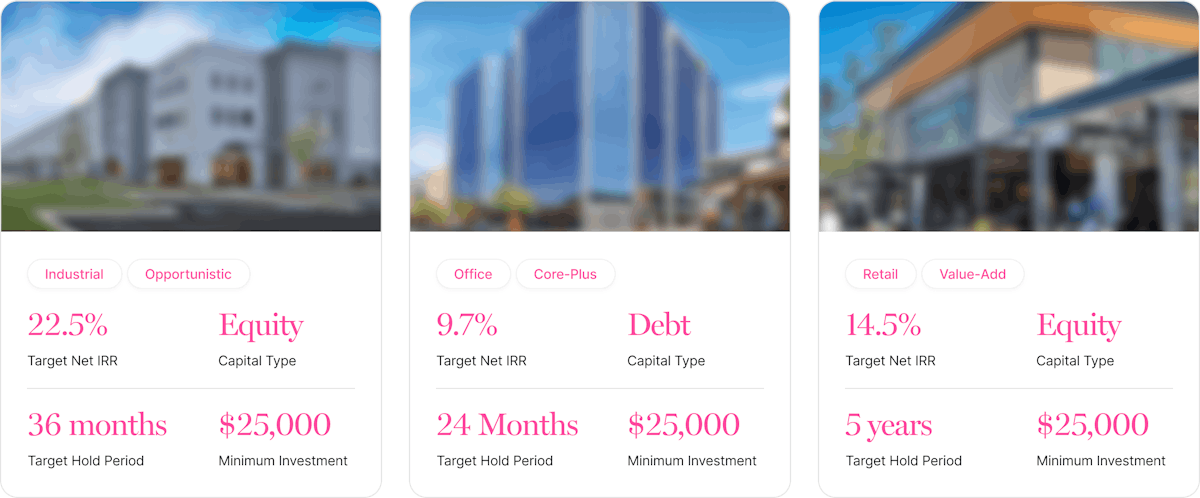

Uncover your next investment

Whether you’re an experienced investor or new to investing, start your journey to a diversified investment portfolio by including direct real estate.

Invest in managed real estate without the difficulties

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=1200&h=684)

A wide array of investment strategies to choose from

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=1200&h=684)

Reach you goals by investing smarter

Invest in managed real estate without the difficulties

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=1200&h=684)

A wide array of investment strategies to choose from

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=1200&h=684)

Reach you goals by investing smarter

Why RealRaise?

At RealRaise we are here to provide a new level of access to private real estate investing through technology. Founded by a team of real estate professionals and technology experts, we want to level the playing field for you to have the same access to building wealth as the world’s largest professional investors.