Investment Fundamentals

The Capital Stack

The "capital stack" in the Australian real estate market refers to the various financing instruments used to fund a specific real estate investment. While homeowners may be familiar...

Introduction - Understanding the Capital Stack in the Australian Real Estate Market

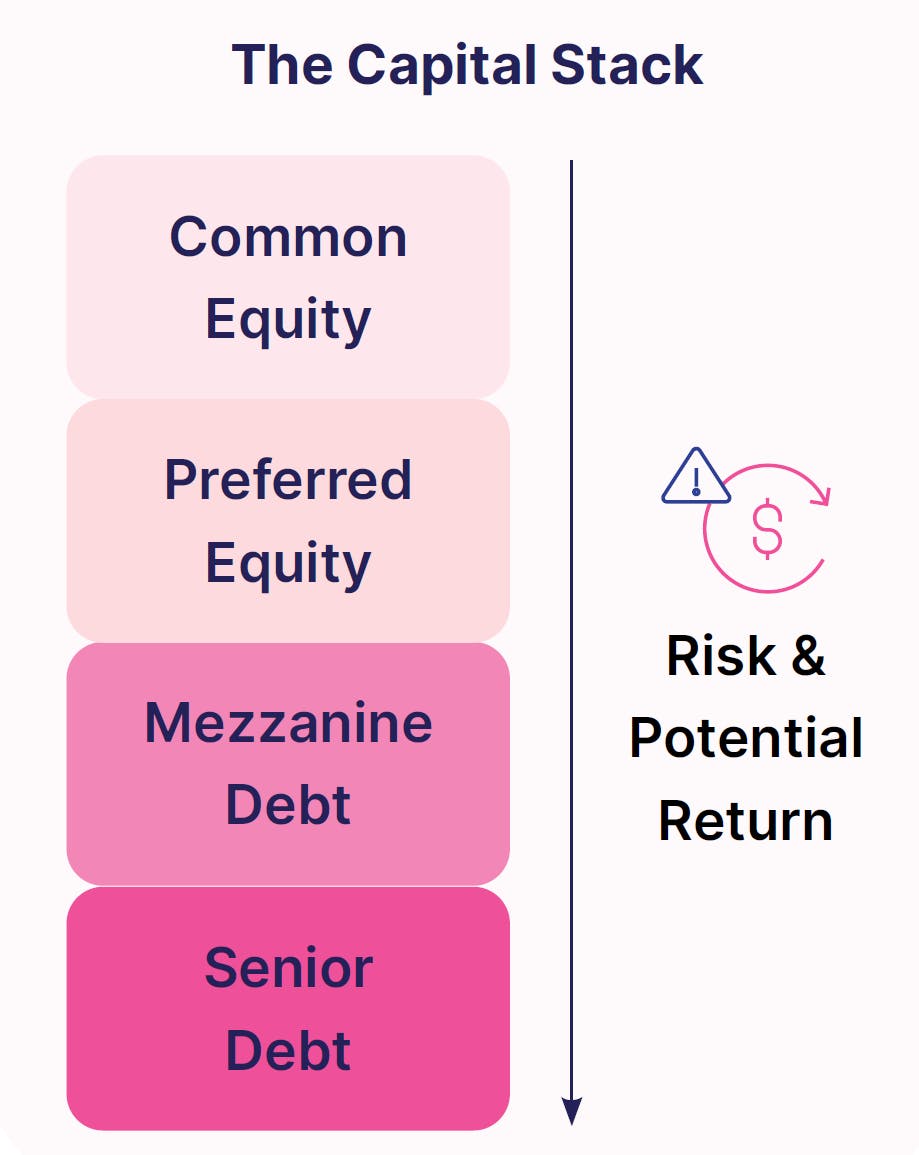

The "capital stack" in the Australian real estate market refers to the various financing instruments used to fund a specific real estate investment. While homeowners may be familiar with the concept of their mortgage and home equity, commercial real estate finance is more complex, involving multiple parties and diverse structures. A wide range of financing instruments can be involved in any commercial real estate transaction, and some of these have gained prominence in recent decades. Even seasoned investors can benefit from a review of the capital stack and its components, such as equity, preferred equity, mezzanine debt, and senior debt.

Similar to a residential home purchase, real estate investment firms (sponsors) in Australia often seek loans from large banks at attractive interest rates, subject to the bank's underwriting and leverage standards. The sponsors also contribute their capital in the form of equity. However, to meet the capital requirements of the project or reclaim capital for other purposes, sponsors may seek additional financing in the form of debt and/or equity to fill the gap between the total projected project cost and the financing already secured from a bank loan and/or their own equity. This financing structure, known as the capital stack, can vary infinitely to meet the sponsor's and project's needs and accommodate additional investors. The capital stack may become complex, featuring multiple tranches of mezzanine debt or senior debt that are later syndicated into various notes. The equity component of the capital stack may involve intricate waterfall payment structures and return hurdles.

For the purpose of this discussion, we will focus on the four primary components of the capital stack commonly encountered when investing in the Australian real estate market through online real estate investment or crowdfunding platforms, listed from the least to the most risky: senior debt, mezzanine debt, preferred equity, and common equity.

Senior Debt

Senior debt in Australia is secured by a mortgage or deed of trust on the property itself. In the event of borrower default, the lender has the right to take title to the property, reducing the risk on the principal invested. This lower level of risk comes at the cost of a lower yield on the invested money. Senior debt investors are entitled to lower returns than all higher positions in the capital stack, as they have payment priority. Evaluating the loan-to-value (LTV) ratio of the loan is essential to understand the risk involved. A loan with a 60% LTV provides more margin for error than an 85% LTV loan, making it more desirable in a worst-case scenario.

Investors in senior debt should closely examine the sponsor's ability to service their debt obligation, considering the debt service coverage ratio and total leverage. Online real estate investing platforms may offer senior debt investments as a direct line of capital to the borrower, allowing individual investors to lend to the sponsor. Alternatively, the platform may syndicate a pre-existing loan from a lender, allowing individuals to invest passively alongside a private commercial real estate lender. In either case, investors should assess the track record and experience of both the borrower (sponsor) and the lender, whether it's the platform itself or a separate private lender.

Mezzanine Debt

Mezzanine debt in the Australian capital stack sits below senior debt in the order of payment priority. Once the developer pays operating expenses and the senior debt payment, all remaining income must go toward paying the fixed coupon of the mezzanine debt. In case the developer is unable to make payments, assuming they are not in default under the senior debt, the lender typically has the authority to take control of the property quickly. Mezzanine debt generally offers a higher return rate than senior debt but lower than equity.

When both mezzanine debt and preferred equity are part of the capital stack, mezzanine debt typically takes payment priority over preferred equity, leading to a lower return rate.

Preferred Equity

Preferred equity in the Australian capital stack is a flexible portion that can be challenging to define generically due to its varied structures. Preferred equity holders have a preferred right to payments over common equity holders. The positions of preferred equity range from "hard" preferred equity, similar to mezzanine debt with fixed coupon and maturity date, to "soft" preferred equity, which may include some financial upside if the project performs well. While hard preferred equity holders may have decision-making authority or the ability to remove the borrower (sponsor or developer) in case of payment default, soft preferred equity holders usually have more limited rights. The return rate for hard preferred equity is similar to or slightly better than mezzanine debt, while soft preferred equity returns can be substantially higher.

Preferred equity investors receive returns paid before common equity holders receive distributions, hence the term "preferred" in preferred equity. Due to this priority and the recourse provisions preferred equity holders may have in case of borrower default, preferred equity is considered less risky than common equity, and the upside for preferred equity investors is capped.

Common Equity: The Top of the Capital Stack

Common equity represents the riskiest and most profitable portion of the capital stack in the Australian real estate market. In most cases, the general partner (GP) investor, such as the developer or sponsor, must invest their own capital as part of the equity to demonstrate their commitment to the project. Equity investments carry the highest risk since all other tranches of capital are entitled to repayment before common equity holders. However, if the property performs well, equity investors have no limit on potential returns. In real estate, equity is typically structured so that all investors earn a preferred return until they achieve a specific annual return hurdle (e.g., 8%). After that, the developer or sponsor receives a disproportionate share of the profits (e.g., 40% of the remaining profit), while investors receive the rest proportionally.

While common equity is generally the highest-risk, highest-upside part of the capital stack, not all common equity investments have the same risk/return profile. Factors such as capitalization rates, the market's location, and the specific business plan can impact the risk and potential return of an equity investment. Negotiating attractive preferred returns can mitigate some downside risk for passive investors, and other qualitative and quantitative attributes can influence risk and return potential for common equity investments.

Conclusion

Incorporating the Capital Stack in Your Australian Real Estate Portfolio

Understanding the different investment structures in the capital stack is crucial when including real estate in your investment portfolio in Australia. The allocation between equity and debt real estate investments should align with your investment goals, strategy, and risk tolerance. Investors with higher risk tolerance may prefer a heavier exposure to real estate equity, while those more risk-averse may find security in short-term senior debt or mezzanine debt.

Diversification across investment structures and target hold periods becomes even more critical during times of economic challenges, such as those posed by the COVID-19 pandemic. Strained credit markets may create opportunities for private lenders, leading to senior and mezzanine debt opportunities, while demand dislocations may offer value-add opportunities for common equity investors. A diversified approach can potentially reduce overall risk exposure while maintaining long-term appreciation and upside across the capital stack in commercial real estate investments.

Latest blogs

Check out our other most recent blog posts!

Real Estate Perspectives

How to invest in industrial?

Real Estate Perspectives

How to invest in hotels?

Real Estate Perspectives